Summerset Group Holdings (SUM) is a leading operator and developer of integrated retirement / aged-care villages in New Zealand, and is starting to expand in the states of Victoria and Queensland in Australia.

Through its aged-care facilities, Summerset offers a “continuum of care” model in which residents can enter a village in an independent unit and potentially transfer into higher needs healthcare units in the same village if required.

Summerset currently provides 6,087 retirement units across New Zealand and Australia, of which 1,284 units are higher needs care units. In total, over 8,000 residents live in Summerset villages and Summerset employs more than 2,800 staff members.

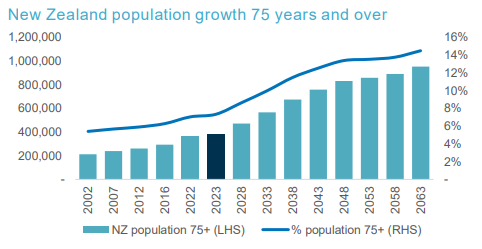

Demographic tailwinds

On the back of a rapidly ageing population base, the retirement village sector has a large demographic tailwind. Over the next 25 years, the New Zealand population aged over 75 years is forecast to double, from 400,000 people to 800,000.

Source: SUM Investor Presentation, Statistics New Zealand

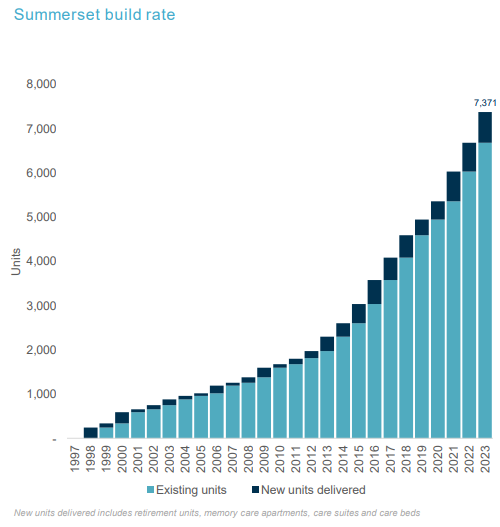

In anticipation of this demographic tailwind, Summerset has experienced rapid growth in development of its retirement village units over the past 25 years. As one can see in the chart below, the new units delivered build-rate has been accelerating further each and every year as the product gets more widely accepted and demand continues to increase. Summerset has an excellent reputation for a high-quality village product and excellent healthcare.

Source: SUM Investor Presentation

Best in class development model

The retirement village sector has experienced many challenges in the past few years. One such challenge has been the impact of the Covid19 pandemic. Summerset was able to continue to deliver a great experience for residents during the Covid period, despite restrictions and increased health risks.

Summerset has also delivered growth in units built despite the challenges of rampant construction cost inflation, a depressed underlying housing market and increasing cost burden of interest rates. Despite those challenges, Summerset has continued to grow earnings.

This continued growth trajectory is partly down to Summerset’s best in class development model, where it has delivered a majority broadacre / villa style product in premium locations. This strategy has enabled development flexibility (an ability to dial up and down unit builds depending on underlying demand), good cash returns from village builds and appropriate levels of care. In the future, this development model should be able to deliver best in class growth, in our view.

Outlook

Summerset is a core holding in many of the Milford Funds. We are supportive of its new village development pipeline and build strategy. The business has been expanding into Australia which is exciting. It delivered its first units in Melbourne, Victoria this year and is evaluating further expansion into the Queensland market. Given demographic tailwinds, high-quality product and well-performing management team, we believe the business can grow strongly over the medium to long term.