Gold is an interesting commodity; beautiful in its glitter and yet it primarily sits in sunless, secured vaults all over the world.

While Milford does not own gold directly in our Funds (we don’t invest directly in commodities), from time-to-time, we may have exposure to gold producing companies.

Recently gold surged through $2,300 USD per ounce for the first time ever, driven by investors’ view that inflation is likely to be stickier for longer, whilst cash interest rates are forecast to get reduced.

When we think about the history of gold, we think most obviously of it as one of the earliest mediums of exchange where, for a time, it was largely unilateral in its use in global trade. In addition, it has widespread use in jewellery, artwork, industrial applications as well as arguably the pre-eminent store of value for a millennia.

One of the founding principles in economics is the relationship between supply and demand. Gold is no different, and when we look at it from that lens it forms a useful framework. Taking supply first, gold’s overall supply does grow through time as gold is not necessarily “consumed” but is often stored. The rate of growth, however, is somewhat constrained given the finite amount of gold available to be mined. For supply to grow quicker (assuming mined gold is just stored), mine production needs to grow, and this is typically a relentless battle against more complex deposits, lower grades and higher costs. Given this, gold is considered scarce, despite additional supply coming to market each year.

Regarding gold demand, there are typically three key drivers which arguably have the most influence over price in the short term:

- Gold tends to be held as an asset by central banks

- Demand for jewellery

- As an inflation hedge and store of value

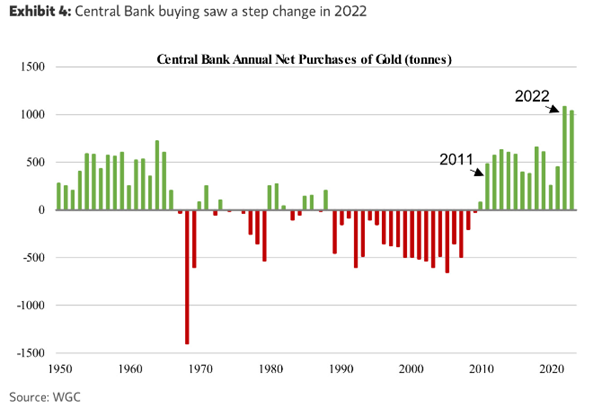

The past few years have seen a volatile backdrop for gold. Gold has seen significant central bank buying in the lead up to the Ukraine War and post. Significant incremental buying in 2023 was seen by China and Poland (Source: World Gold Council). One of the arguments here for central bank buying is to help some economies be less reliant on the US dollar and US dollar assets – this trend was exacerbated by the seizure of Russian foreign exchange reserves by the US (essentially not allowing them to access their US-held dollars). Gold provides a diversified set of reserves for central banks and is particularly common in some emerging markets.

In many economies the purchase of gold jewellery is a sign of wealth, and can be gifted to family members. This tends to support end-retail demand for gold. For example, this year has seen a 24% increase in demand for gold over the holiday period in China, given it is the year of the Dragon (Source: World Gold Council).

Arguably, a more complex driver, is the perception of gold as an inflation hedge. This is a complex interplay that in its simplest logic states that if growth is high, this tends to be when the supply of money in the economy is growing. Unless interest rates are raised to slow growth, inflation is higher which reduces the purchasing power of that currency. The value of an asset like gold, however, should retain its relative purchasing power. This drove its relatively strong performance during past inflationary periods such as the 70s and 80s. An even simpler explanation is that when there’s more money chasing a finite asset, the value of that asset should increase. Conversely though, if a central bank is pursuing tight monetary policy to contain this inflation, it can have the opposite effect on gold. Remember with gold you generate no income if you own it, you only make money if you sell it for a higher price. Therefore, if one can earn a return of more than inflation by having cash in a bank account, there can be a significant opportunity cost to owning gold.

Why is this interesting now?

When central banks begin cutting interest rates to support growth, you tend to see real interest rates (interest rates adjusted for inflation) also decline, and therefore an improvement in the value of scarce real assets like gold. Where this gets increasingly complicated is around the nature of central bank policy (are they cutting because growth is deteriorating or is it because inflation is under control?), and timing of moves (do they cut aggressively, slowly, intermittently?). It is also intertwined with central bank physical buying of gold which at this stage remains elevated.

At the moment, interest rates are high relative to the past five years (albeit not versus long run history), and in turn “real” interest rates are higher than they have been at any point in the past few years. As the expectation for cash rate cuts and by extension lower “real” interest rates get priced by the markets, this tends to drive higher gold prices in the shorter term, which is a phenomenon we are seeing today.

We appear to be in an environment suitable for gold to perform well with growth and inflation higher, as well as one where there is a chance of lower global interest rates which would likely continue to be supportive for gold. So whilst we are not necessarily calling the gold price to continue going up, there is certainly a scenario where scarce assets like gold continue to appreciate in price.