Image: Boss Energy

Boss Energy (BOE) is a prospective uranium miner in South Australia. We first acquired BOE shares at $2.48 a share and it has performed exceptionally well, rising approximately 119% since our initial investment.

To understand what makes Boss special – other than its fantastic name and a great asset– is to appreciate what’s happening in the industry it operates in.

The imbalance is significant

Nuclear energy, although historically divisive, has become increasingly accepted as a fantastic energy source. As the world transitions away from fossil fuels, we’ve discovered that many of the characteristics we wanted in our future energy source, were already at our fingertips.

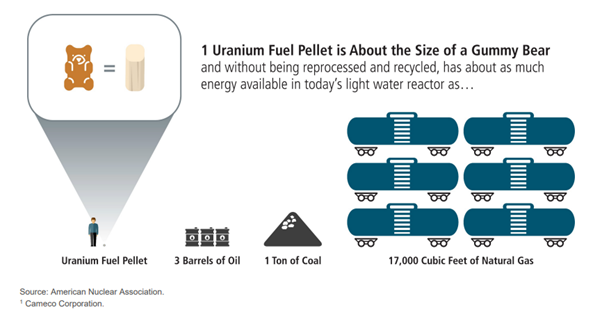

Firstly, nuclear is incredibly efficient. One enriched tablet has the same energy output as one ton of coal or 17k cubic feet of natural gas.

1

Given nuclear heats water, which then turns into steam, the obvious takeaway is the lack of carbon emissions. In fact, the London School of Economics estimates 1.5 gigatonnes of global emissions are avoided each year due to nuclear power.2 To put that in perspective, that’s almost 20x New Zealand’s 2021 emissions.

Now I’m not ignoring the risks – namely nuclear meltdowns and its waste – however I encourage the reader to objectively research these issues – refer to this blog as a starter. A great example of this, is that since 1950 all the nuclear waste produced in the US could fit into one American football field at a depth of 9 metres 3 and there have been zero reported issues or injuries storing this material.

Beyond its efficacy as a carbon-free energy source, there’s a significant supply/demand imbalance building. Although slightly murky, annual uranium demand is approximately 180m/lb and production is currently 150m/lb a year. Although demand was already building it is expected to accelerate post declarations made at the COP 28 climate conference. 22 world leaders sign a declaration with the aim of tripling their nuclear energy by 2050 – the largest endorsement of nuclear energy’s place in the transition away from fossil fuels.4 This could see nuclear energy go from 10% of global power generation, to almost a third within 25 years.5

Supply is tricky to establish given the strict regulation around uranium production and hence, the supply response will take a long time to materialise. Recently both Cameco and Kazantamprom, the two largest uranium miners globally, have downgraded their production guidance. This issue is compounded by Russia and Kazakhstan collectively accounting for 51% of global supply6 – as supply chains bifurcate, western economies must look elsewhere for uranium.

The significant production gap is unlikely to be resolved in the near term and we’ve already seen spot prices move up significantly.

Boss Energy

With that backdrop let us turn to Boss Energy (BOE). BOE control a deposit in South Australia called Honeymoon. The Honeymoon project has a resource of approximately 72 million pounds (m/lb) of uranium – a significant deposit that has grown by 4.3x since BOE acquired the asset, due to successful exploration activities. This has materially increased the life of the mine.

They currently have permission to export up to 3.3m/lb of uranium a year, however the initial stages of the project are targeting 2.45m/lb. They are starting the process of planning how they will achieve >3m/lb p.a. of production which if achieved, will lead to significant cash flow to shareholders.

The beauty of the project is that it’s also very low cost given they’re employing the most common extraction method, In Situ Recovery Mining. This makes them highly profitable at various points on the cost curve.

Recently they acquired a 30% share in a US miner that also employs In Situ Recovery as their mining process. This diversifies their asset base, and increases their annual production potential.

Finally, Australia has 28% of the world’s uranium in its soil, but they only account for 9[1]% of global supply. Given Australia is a stable jurisdiction with very well-established global supply chains, any supply from Australia is highly sought after and miners generally trade at a premium compared to some global competitors.

Outlook

As I’m sure you’ve deduced, the outlook for the uranium sector is very strong. Supply/demand imbalances are unlikely to abate in the near term, allowing significant cash flows to be generated by those who can meet this demand.

Boss is very well positioned with a high-quality asset and upside to its annual production targets. They are going through the process of ramping up production which generally sees a few mishaps along the way. This coupled with the incredibly strong share price performance has seen us manage our position size. Nonetheless we remain very bullish on Boss Energy and the uranium sector and will await consolidation to re-establish our full position.

____________________________________________________________________________________________________

[1] https://sprott.com/media/6611/sprott-physical-uranium-trust-investor-presentation-q3-2023.pdf

[3] https://www.energy.gov/ne/articles/5-fast-facts-about-spent-nuclear-fuel

[4] https://www.oecd-nea.org/jcms/pl_89153/cop28-recognises-the-critical-role-of-nuclear-energy-for-reducing-the-effects-of-climate-change

[5] DW

[6] https://worldpopulationreview.com/country-rankings/uranium-production-by-country