Betting on innovation

The world is at the start of a promising new chapter of innovation that will no doubt transform the global economy. Digital technologies such as artificial intelligence, big data, cloud computing and the internet of things are booming. Our challenge as investors is to discover the most promising of these companies, avoiding the many with unrealistic ambitions and business models.

While we are busy trying to find the next ‘unicorn’ (a term used for companies that grow rapidly to a $1b+ valuation) to add to the portfolio, we’re currently invested in a company that is also a beneficiary of technological innovation, albeit with less glamour. IPH, or Intellectual Property Holdings is one of the leading Intellectual Property (IP) firms in the Asia Pacific region. It provides services for the protection, commercialisation and enforcement of all forms of IP including patents, trademarks and designs. IPH operates across nine jurisdictions in APAC and North America, servicing more than 26 countries across the region.

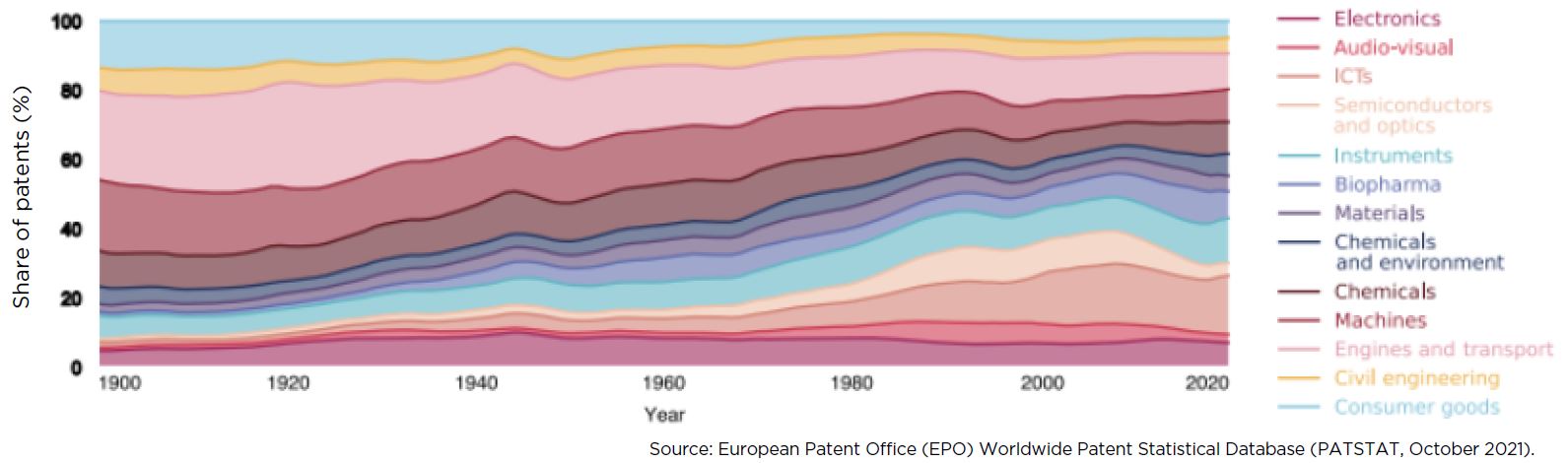

The demand for patents is leveraged to innovation and over time, irrespective of changing world powers and geopolitical events, innovation has remained constant. Whether it was the invention of the steam engine, the combustion engine, the 1930s pharmaceuticals boom or the internet revolution of the 90s and 2000s, we have experienced and should continue to expect significant innovation. The more innovation, the more patents are required to be filed and the more firms like IPH benefit.

A century’s shift from engines toward ICT innovation

Shares of patents by technological field, 1900-2020

There are a number of other attractive characteristics underpinning our investment view on IPH:

i) A diverse top tier client base with established long-term relationships. Of the top 35 clients for the group, all had been clients for more than 10 years. Helping to ensure a diversified client base, no single client represents more than 3% of IPH’s revenue.

ii) Incredibly cash generative. The nature of IPH’s billing cycle (a large number of relatively low value invoices) results in low working capital requirements and high cashflow conversion.

iii) Leveraged to a falling Australian Dollar. With 80% of the revenue base in currencies other than Australian Dollars, IPH’s profits are highly leveraged to a falling Australian Dollar.

iv) Upside from acquisitions. The recent acquisition of the leading Canadian IP firm Smart & Biggar unlocks a new region. Smart & Biggar was founded in 1890, and files over 6,000 patents a year. We believe there is a considerable scope for consolidation in Canada given a highly fragmented market consisting of a long tail of smaller/mid-sized firms.

IPH has superior financial characteristics to peers which include high margins, a capital light balance sheet, strong cashflows and M&A opportunities. We believe the outlook is bright for IPH, and the share market is in the process of recognising the opportunity.