Reshoring of the global semiconductor supply chain

To say the US-China relationship has devolved over the past several years is a grand understatement. The two superpowers are in a technological cold war

To say the US-China relationship has devolved over the past several years is a grand understatement. The two superpowers are in a technological cold war

Mobile network operators (MNOs) such as Spark & Vodafone often own valuable infrastructure assets but are not rewarded for owning these assets in their valuations.

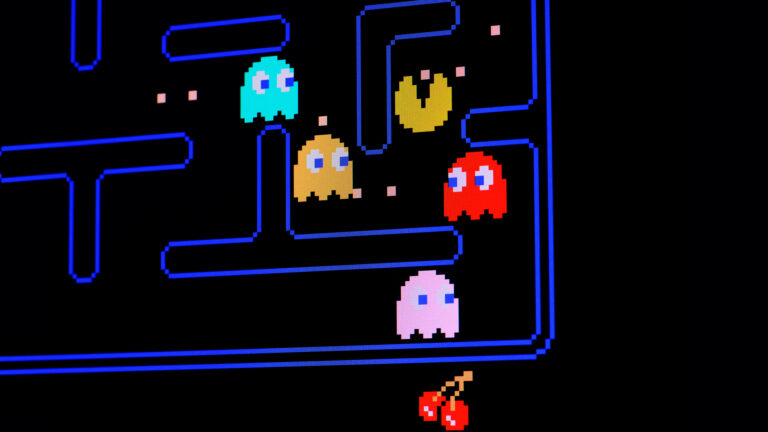

Far from being the stigmatised pastime of one’s childhood, video gaming has gained widespread social acceptance in recent years and is finally receiving the recognition befitting an industry of its stature. It may be surprising to learn that video gaming is the largest segment within the global consumer media & entertainment landscape by a wide margin, with various third-party sources pinning industry revenues at US$180-200 billion and forecast to grow at a mid-to-high single digit rate over the foreseeable future

Milford’s Sustainable Investment team has two responsibilities. First, to help the broader Investment team assess risks and identify opportunities from sustainability as we work to

Nuclear Power is arguably one of the more divisive topics, however, given the global energy crisis, there’s been a shift in sentiment towards nuclear power,

The recent bid for AGL caught many by surprise, particularly as the offer was made by a consortium that included one of Australia’s most successful

The seemingly never-ending question of will NZAS (New Zealand Aluminium Smelter) stay or go from Tiwai Point may finally have turned the corner over the

Since the beginning of the pandemic, fintech, and particularly digital consumer payments, has been the new hotness. While Australian investors may be most familiar with

Every now and again a term comes along that defines a type of technology that grips everyone’s imagination. Unfortunately, rarely do these technologies live up

In May this year I wrote a blog about buoyant conditions being a major catalyst which encourages a migration of private companies to the public

Food security, or access to sufficient safe and nutritious food, is one of the most important challenges facing the world today. The global population is

How much would you pay to own this pixelated image of an alien wearing a sweatband? Nothing? $1? $1,000? How about US$7.6 million? It sounds

Subscribe to weekly insights from our investment experts