Why corporate bonds are looking more attractive relative to equities

Throughout the pandemic and up until 2022, the relatively low interest rate environment has made it tough for corporate bond yields to compete with the earnings or dividend yields generated by equity investments.

However, rising global interest rates have changed this dynamic, and bond yields are now looking more attractive than they have in a long time.

Corporate bonds are debt instruments issued by companies that typically pay a regular fixed interest payment for the life of the bond, until the initial investment amount is repaid to the investor. The amount of the periodic interest payment is set at a rate that reflects the interest rate environment at the time the bond is issued. In a low interest rate environment, bonds typically have a lower yield and vice versa.

Equities (or shares) reflect an ownership stake in a company. Returns on an equity investment are tied to company earnings. Higher earnings typically support higher dividend income paid to the investor (noting not all equity investments pay dividends), as well as share price appreciation.

While not without its own risks, bond interest payments are a contractual obligation of the company, required to be paid in all but the most extreme situations. A dividend payment for an equity investment is, however, discretionary. In a weaker economic environment, where earnings may be lower, this may see reduced dividend payments (and therefore a lower dividend yield). Bonds also have an advantage of higher priority claim to repayment versus equity holders in a downside scenario such as a company failure, but do not benefit from the upside of company earnings growth that supports equity share price appreciation.

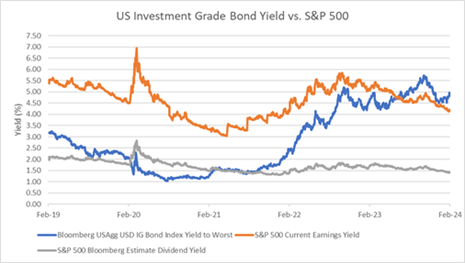

Since 2022, interest rates have been on the rise globally as central banks have tightened monetary policy in an attempt to curb inflation. The rising interest rate environment has created several headwinds to growth for company earnings: slower economic growth, rising unemployment and falling consumer demand. The graph below demonstrates how US investment grade bond yields have risen following the commencement of rising interest rates, and now exceed both the earnings and dividend yield for equities in the S&P 500.

Taking all these factors into consideration, this explains why bonds continue to look more attractive than they have in years.

Bloomberg as at 15/02/2024