Milford Australia has brought two new funds to market, including a fixed income strategy launched in response to growing adviser demand for more liquid, transparent credit solutions.

The launch of Milford’s Corporate Bond Plus Fund comes at a time of strong growth in credit investing in Australia, fuelled in part by the expansion of private market offerings.

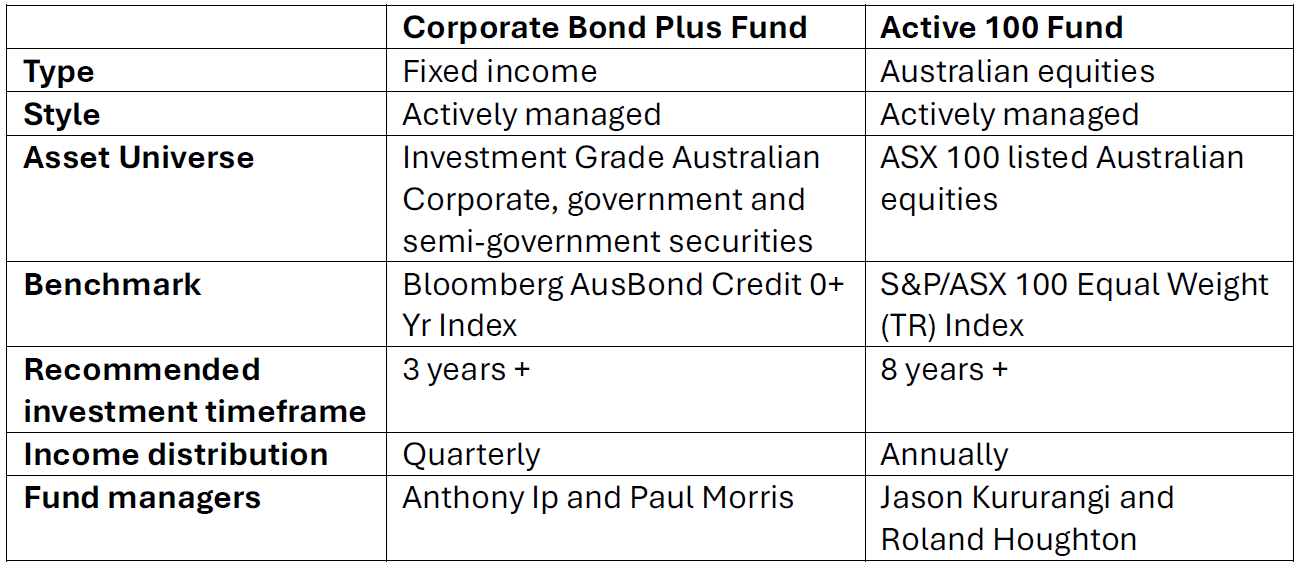

The new Milford fund invests predominantly in publicly traded Australian investment grade corporate, government, and semi-government securities. It offers daily liquidity, and an active management approach which uses multiple levers to generate alpha.

Commenting on the fund’s launch, Wayne Gentle, Chief Investment Officer and Executive Director for Milford Australia, said “Advisers are telling us the conversation has shifted, and whilst there is still a strong appetite for fixed income offerings that work harder for investors, there is also a desire to avoid surprises.

We believe advisers will be receptive to an actively managed differentiated fixed income fund that targets alpha generation in a liquid and transparent fashion,” said Gentle.

“This strategy isn’t just about security selection or interest rate duration, alpha is generated from multiple sources including sector rotation and relative value opportunities,” he said.

“We feel this is quite a unique offering in the market, and this timing is very opportune for advisers,” said Gentle.

The fund is benchmarked against the Bloomberg AusBond Credit 0+ Yr Index, an index truly representative of liquid Corporate Bonds.

At the same time, Milford has also launched a new high conviction domestic equity fund – the Australian Active 100 – designed to tackle the concentration trap in many Australian equity offerings.

The Active 100 is benchmarked to the S&P/ASX 100 Equal Weight Index and is managed as a high conviction Australian equity strategy targeting the most compelling opportunities across the ASX 100, regardless of size, style, or sector.

Gentle said the choice of the Equal Weight Index as the benchmark was based on the belief that it allows far more room to express stock-specific views and generate alpha rather than beta.

“Advisers are becoming increasingly disillusioned with the ASX 200, one of the most concentrated benchmarks in the world, and thus susceptible to outsized moves as we recently saw with CBA and CSL.

“While the equal weighted index is a harder benchmark to beat, philosophically it’s more strongly aligned with our high conviction approach,” he said.

“This fund offers the familiarity of the ASX 100, but the equal weighted approach allows for greater diversity of sector exposure and thus more opportunity for genuine alpha,” said Gentle.

Both funds are open now.

FUND PROFILES