Consumer spending serves as a barometer for the health of a nation’s economy and the sentiment of its consumers. Last year proved to be a difficult year for consumers globally, as households grappled with rapidly rising interest rates and sticky inflation which saw a steep decline in discretionary spending. While we are seeing the contraction in spending continue, the extent of decline seems to be losing momentum. So, is consumer spending and sentiment improving or are Aussies running out of options to keep reducing spend amidst inflation?

The Cost of Living Insights report by CBA revealed total per capita spending increased 2.5% in March, though it lagged inflation. Additionally, retail sales saw a year-on-year rise of 1.3% in the combined months of March and April. But where is the spend going? And what does this say about the state of the Australian consumer? It is clear that consumption is nuanced with averages likely hiding the tails.

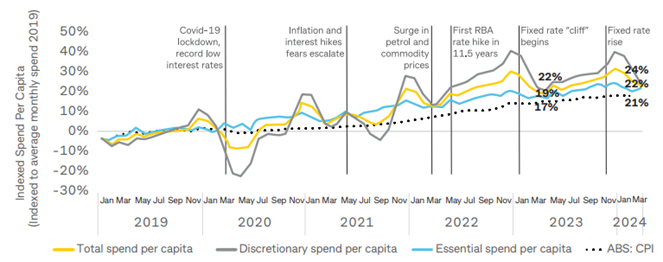

People are cutting discretionary spend, while spend on essentials continues to grind higher with inflation.

Source: CBA iQ | Cost of living Report | May 2024

Essential expenses surged by 3.6% year-on-year, fuelled by insurance, medical bills, and pharmacy goods. Meanwhile, discretionary splurges saw only a modest 1.4% uptick, driven by experiences such as travel and entertainment.

Delving deeper, Australians dining out shifted towards more affordable options like fast food, while leisurely café and casual dining only experienced modest growth. The pointy end of discretionary spend, like household goods and apparel, was lower again than last year.

Source: CBA iQ | Cost of living Report | May 2024

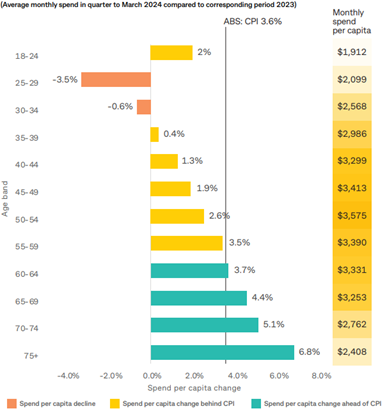

While headline data shows that households are pulling back total spending, the impact is not uniform. The chart below shows that spending among those aged over 60 has outpaced inflation, whereas individuals aged 25 to 29 have reduced their expenditure by 3.5% compared to last year.

This bifurcation of consumption patterns highlights the emergence of a K-shaped economy – an economy where some households are struggling while others are seeing their wealth and incomes grow.

Source: CBA iQ | Cost of living Report | May 2024

What does this mean for consumer-facing companies? Recent months have been turbulent for consumer-discretionary companies, with a slew of profit warnings signalling cracks in consumer discretionary spending.

In a recent disclosure, JB Hi Fi, the prominent electronics retailer, unveiled a concerning trend: its third-quarter like-for-like sales growth turned negative in Australia. Attributing the downturn to the financial strains faced by Aussie households adjusting their spending habits amidst escalating cost-of-living pressures, JB Hi Fi’s revelation set a sombre tone for the retail landscape. Joining the chorus of woes are many other retailers like Baby Bunting, The Warehouse Group from New Zealand, and Michael Hill Jewellers, all echoing similar sentiments of dwindling sales.

The automotive sector – a highly discretionary category – is also expecting a challenging road ahead. Peter Warren, an ASX listed new and used car retailer, issued a cautionary note, citing weak operational performance driven by the pervasive impact of cost-of-living pressures on consumer demand. Mirroring this sentiment are Eagers Automotive and Bapcor, both grappling with subdued demand, heightened discounting strategies, and a shrinking order backlog.

Across the retail spectrum, resounding feedback emerges: consumers are searching for value, seeking deals and responding well to promotions. Additional rate hikes could further dampen consumer activity and confidence. However, stage three personal income tax cuts which begin in July will be a welcome addition to consumers’ pockets, expected to help consumer spending.

While signs of a downward momentum in discretionary spending are waning, it doesn’t seem to stem from improving consumer optimism. So while we take a cautious stance on the Australian consumer, we see select opportunities in areas like travel which have a larger exposure to over 50s, who on average are seeing their wealth improve.